Everything you need to know about KYC

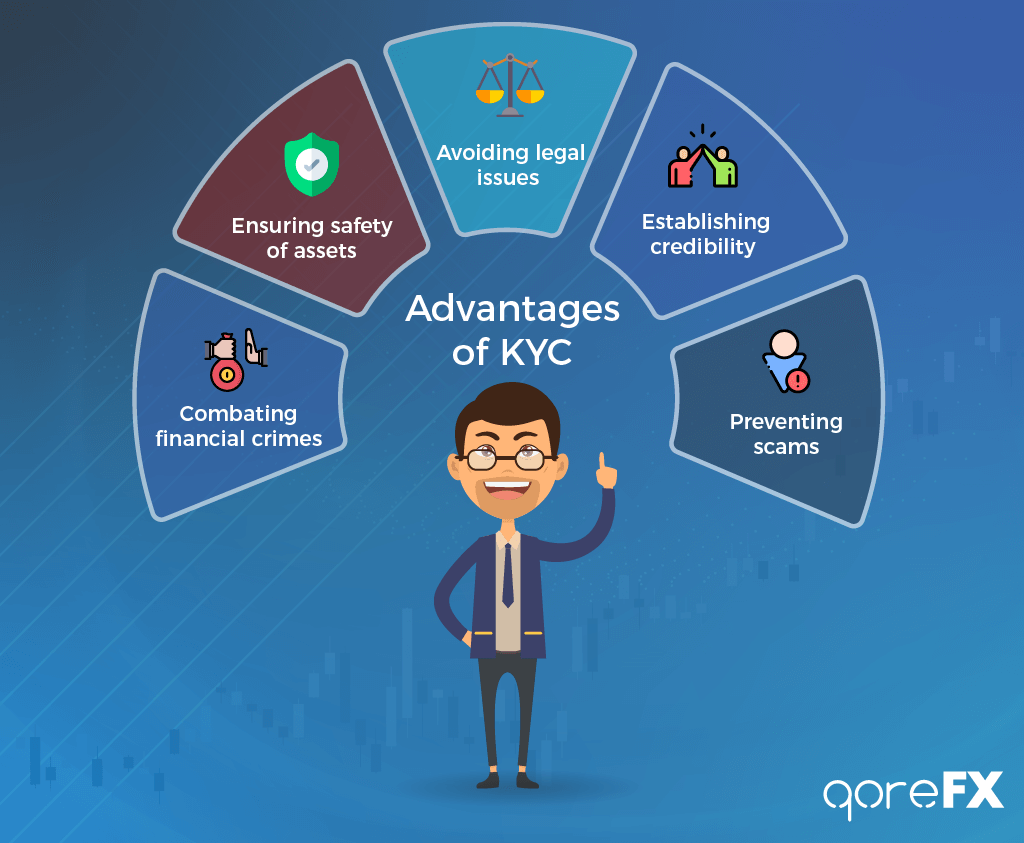

KYC or Know Your Customer is a must know term in Forex and any other financial institution. The process that allows compliance teams to verify the identity of their customers and clients before admitting them to their company’s service, has been acting as a shield from any kind of illegal activity that has to do with money for many years. Its goal is to establish who the customer is, asses all possible risks and make sure that the customer’s financial source is legitimate.

In most Forex companies, KYC isn’t just a legal obligation, but also offers access to lots of premium benefits like faster and bigger transactions.

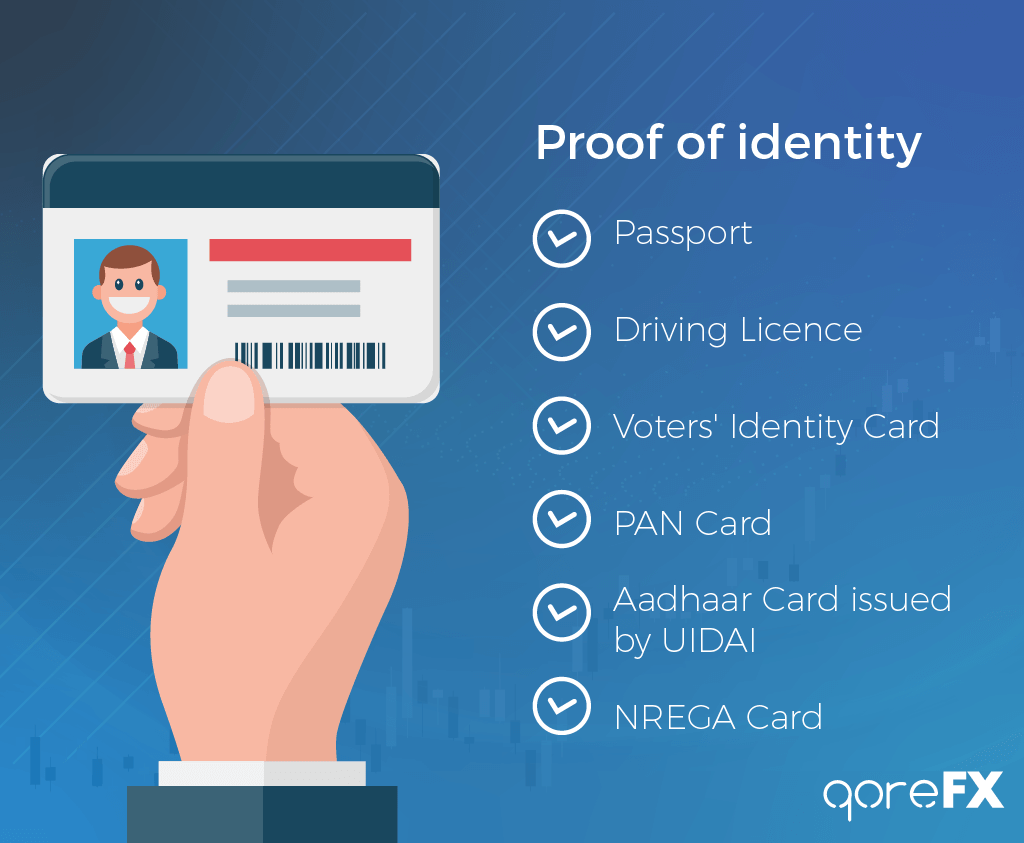

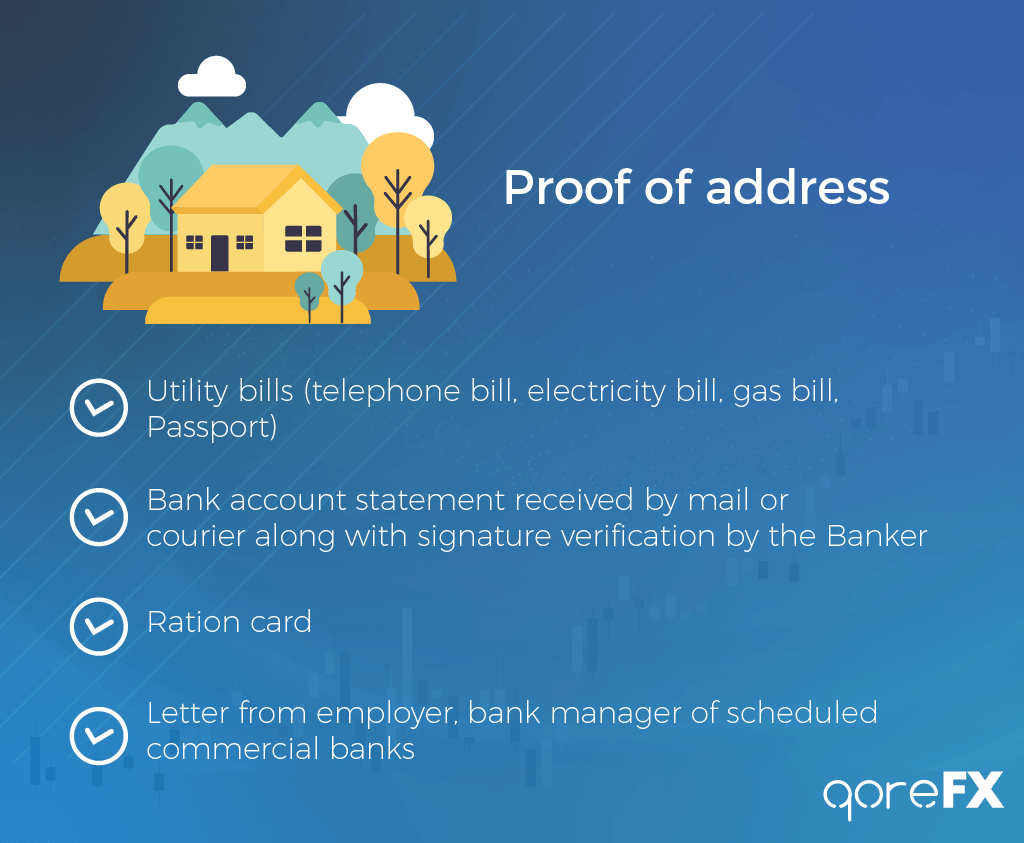

The process usually begins with the collection of a customer’s general information either electronically or personally. This information is later used to check if any of it matches the list of supects of financial crimes or politically exposed persons. At this stage risk assessment is the key element that is needed.

Depending on the trading account package the customer is going for, a Forex company will perform either Simplified, Basic or Enhanced due diligence to verify if the customer is trustworthy or not. These are usually set to identify the location and occupation of a person, the type of transactions they will be performing, their expected method of payment and their expected trading patterns.

All materials collected are filed and stored in case of an audit. They are also used to compare the information companies receive from their ongoing customer activity monitoring.

After an evaluation of the potential customer has been made and an account strategy has been designed, they are given permission to start trading.

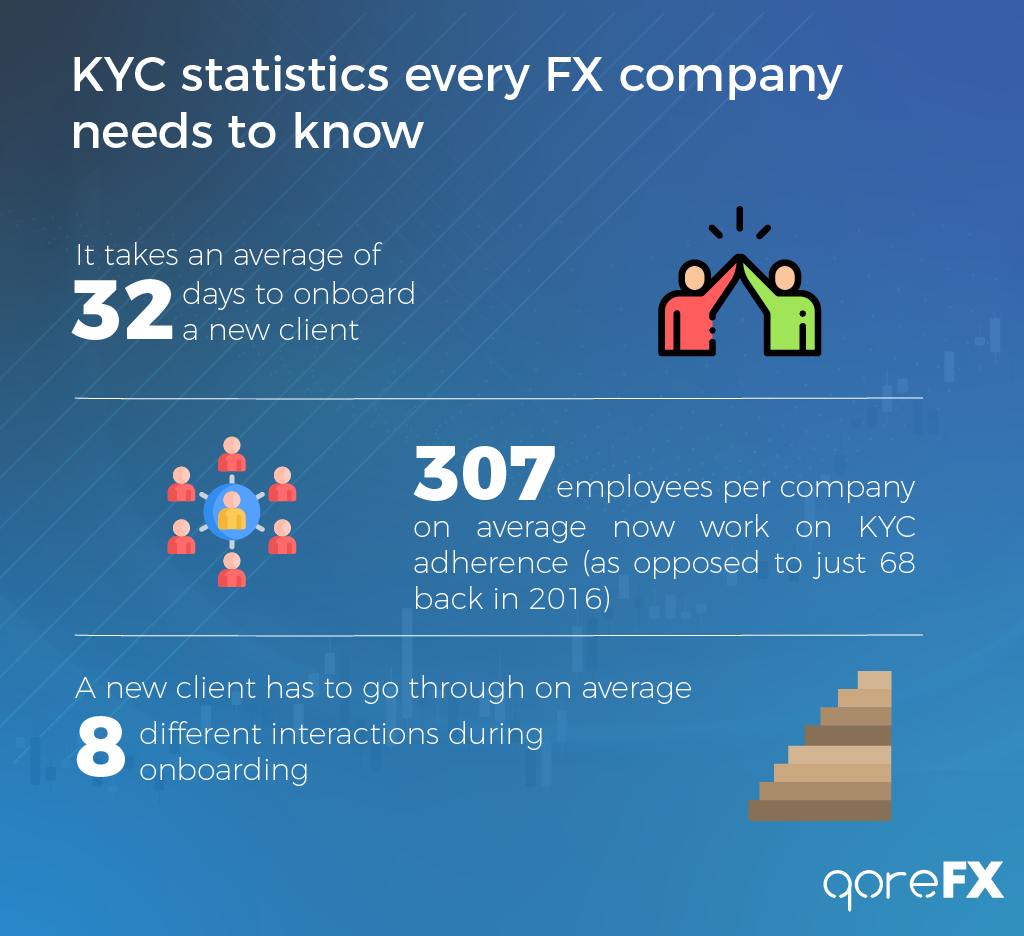

Because of the subject’s complexity and its dynamic nature, compliance teams have to do everything they can to keep up with all the changes. This is also why KYC compliance is unbelievably expensive. According to Thomson Reuters, even though financial firms’ average costs to meet their obligations are $60 million, some are spending up to $500 million on compliance with KYC and Customer Due Diligence (CDD).

The same research discovered that both financial firms and their corporate customers agreed that lengthening KYC procedures are putting more strain on on-boarding processes and client relationships.

On the other hand, these challenges caused the Fintech sector to actively develop new electronic KYC solutions to answer to the market’s needs, and they quickly gained dominance in the field.

These solutions are quicker, more accurate, cost efficient and adaptable. Their capabilities are expandable thanks to more new APIs created everyday and they help to elevate strategic analysis. Finally, they simply offer a much more client orientated service as they are often even accessible via mobile devices.

eKYC helped FX companies to reduce time and cost of their compliance departments, sped up their onboarding processes and allowed them to be more effective.

We cannot talk about eKYC without mentioning automation. Automation has helped compliance departments integrate systems to avoid bottlenecks, fish out duplicates with a click of a button and monitor outdated data. It has allowed multiple Forex companies to build a more transparent and better-oiled process within the departments and allowed them to adapt to new regulatory requirements much quicker than before.

KYC automation allows FX Compliance departments to focus on their priority tasks. For example, a CRM system like QoreFX can help speed up verification processes, produce detailed KYC process flow charts and reports, enabling faster and better decisions, and align processes to match risk ratings. It also simplifies the preparation for an audit as it provides easy access to all the history of actions taken on a customer profile down to the date, allowing you to prove compliance when the time comes.

Author: Nadia Ivanova, PR & Digital Marketing Manager at Qobo Group Ltd